The non-fungible token (NFT) market has faced one of its weakest periods in 2024 since its surge in popularity began in 2020.

Both trading volume and sales counts have seen significant declines, according to a recent report from the analytics platform DappRadar. Compared to 2023, trading volume dropped by 19%, while sales counts fell by 18%.

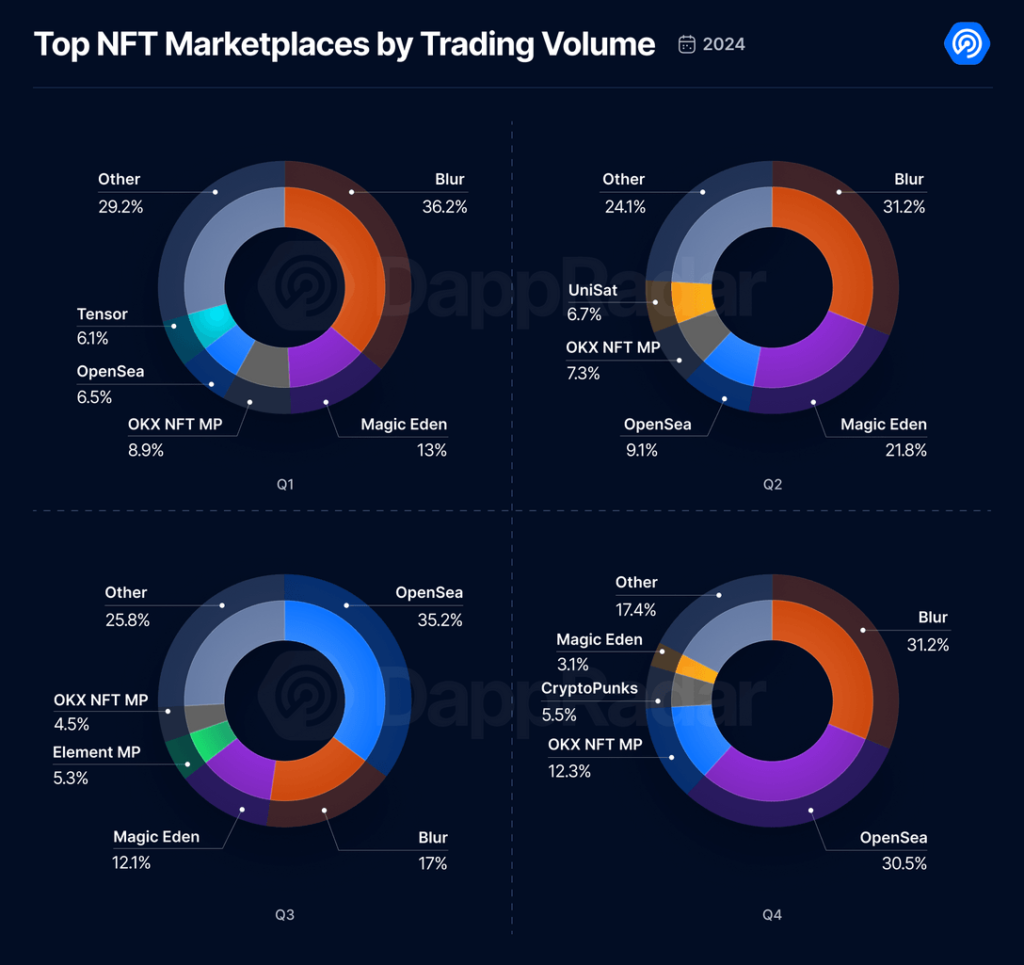

Despite the overall downturn, some platforms and collections retained their positions in the market. Blur emerged as the dominant NFT marketplace in 2024, maintaining the largest share of trading volume.

Magic Eden, meanwhile, overtook OpenSea, which has been struggling recently after receiving a Wells notice from the U.S. Securities and Exchange Commission (SEC).

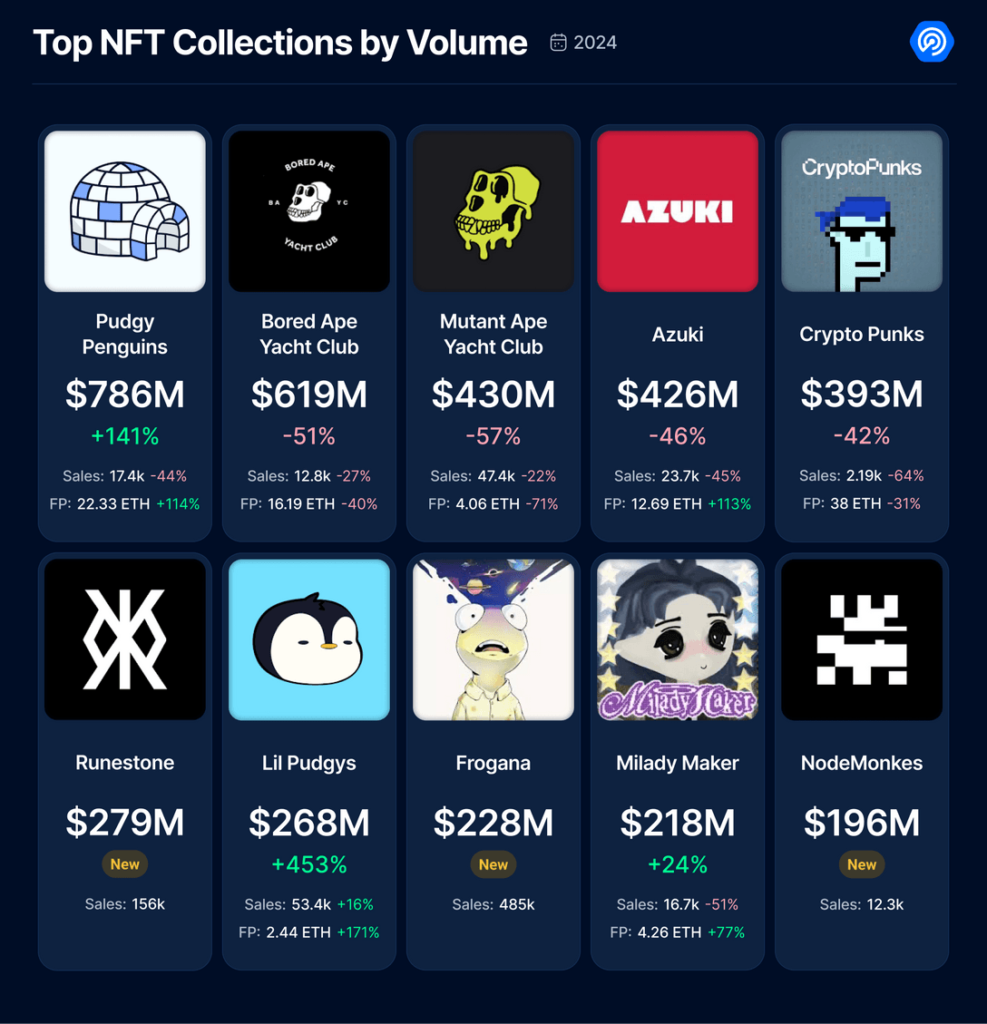

Among NFT collections, Pudgy Penguins stood out by maintaining its lead. Although its sales count dropped by 44%, the collection’s floor price increased by 114%. This growth may be linked to its strategy of combining digital assets with physical products.

The collection introduced Pudgy Toys across various retail chains, including Walmart, Target, Lotte Group, and Big W in Australia. By December, Pudgy Penguins became the second-largest NFT collection by market capitalization and announced the launch of its official coin, “$PENGU.”

In contrast, Yuga Labs’ flagship collections — Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) — hit significant lows in 2024.

BAYC’s floor price dropped to 15.38 ETH (approximately $52,000), a steep decline from its 2022 floor price of around $150,000. In April 2024, BAYC’s floor price reached its lowest point since August 2021, and by September, BAYC NFTs had lost 80% of their value.

MAYC followed a similar trajectory, with its floor price falling to 2.5 ETH (approximately $8,454).

Looking ahead to 2025, the report suggests the NFT market may enter a phase of consolidation and innovation. It anticipates growth in mainstream adoption, driven by enhanced user experiences and expanded applications in areas like supply chain management and digital identity.